►TagesTrading 04. September 2006

|

|  | |||||||||||

DAX Wochenanalyse: Die Lage bleibt freundlich

In der Vorwoche tastete sich der DAX weiter aufwärts und erreichte das bereits früher an dieser Stelle anvisierte Kursziel bei 5900 Zählern. Im Wochenvergleich ein Gewinn von 65 Punkten bzw. 1,1 Prozent.

Mit Blick auf die beiden oberen Schaubilder bleiben die mittelfristigen Aussichten damit positiv. Kursziel für die kommenden Wochen bleibt weiterhin das Jahreshoch bei über 6100 Zählern. Auf diesem Niveau, aktuell bei 6113, verläuft auch das obere Bollinger Band auf Wochenbasis. Insofern dürfen Anleger mit weiter kletternden Kursen bei den deutschen Blue Chips rechnen.

Kurzfristig sieht das Bild jedoch weniger freundlich aus, da die Notierung einerseits an dem schwachen Widerstand bei rund 5900 angelangt ist, und andererseits der Stochastik schon wieder in die überkaufte Zone eingetaucht ist. Eine erneute kurze Verschnaufpause ist daher nicht ausgeschlossen. Allerdings ist auch ein rascher Durchbruch der 5900 mit anschließenden Anstieg bis auf rund 6000 Zähler denkbar, bevor eine Konsolidierung einsetzt.

Anleger sollte daher einfach weiterhin positiv gestimmt sein. Solange der DAX nicht unter 5730 Punkte fällt, besteht aus heutiger Sicht kein Grund zur Sorge. Wer sich bereits mit dem Ausbruch aus dem Dreieck positioniert hat, sichert nun einfach großzügig ab.

Autor: Oliver Schultze

|

Termine für den 04.09.2006

|  |

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Alle Angaben ohne Gewähr

Wünsche allen good trades!

Gruß

Gruß Moya Indexstand: 16.390,37 Kurs Zeit: 06:21 Veränderung:  256,12 (1,59%)

256,12 (1,59%)Letzt. Schlußk: 16.134,25 Eröffnungskurs: 16.280,18 Volumen: 0 Tagesspanne: 16.280,18 - 16.390,73 52W Spanne: 12.498,40 - 17.563,40

Belastet jetzt die Jahreszeit?

Die ersten Kommentare "vom schwachen September" sind in diesen Tagen zu lesen. Es stimmt: Der September ist der statistisch schwächste Börsenmonat. Viele Korrekturen fielen in den letzten Jahren in diesen Zeitraum. Im aktuellen Jahr könnte diese ausgeprägte Schwächephase aber durchaus ausfallen. Die Korrektur im Sommer erfüllt bereits alle Mindestanforderungen an eine technisch vollständige Abwrätsbewegung. Ich habe heute die Situation beim Dow Jones - der die weitere Entwicklung der Aktienmrkte maßgeblich bestimmen wird - für Sie analysiert.

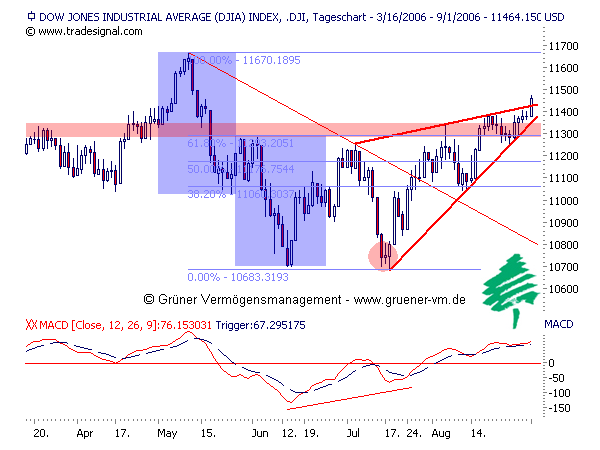

Dow Jones Tageschart mit Bearkeil

Der Dow Jones hat - wie viele andere Indizes auch - einen Bearkeil im Tageschart gebildet. Am Freitag wurde die Oberkante leicht und "regelwidrig" nach oben gebrochen. Das Julitief erfüllt alle Voraussetzungen für eine abgeschlossene Korrektur. Eine positive Divergenz hat sich durchgesetzt. Kurzfristig wird die Situation zunehmend überkauft. Mit einem Rücksetzer muss gerechnet werden. In den kurzfristigen Zeitfenstern haben sich erste negative Divergenzen gebildet.

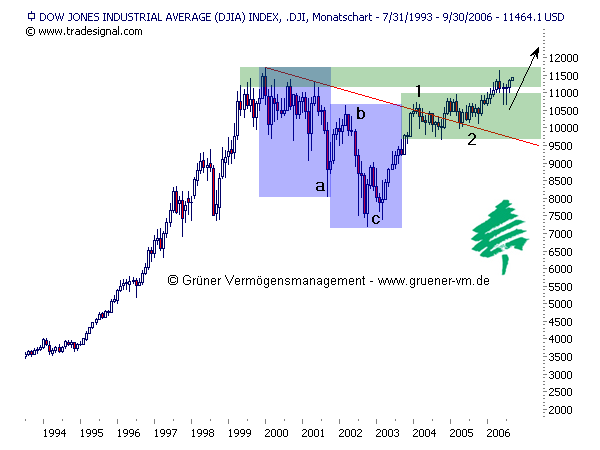

Dow Jones Wochenchart

Nach dem ersten Fehlausbruch aus der fast dreijhrigen "Seitwärts-Leicht-Aufwrts-Bewegung" nach oben, versucht sich der Dow Jones nun ein zweites Mal an diesem Widerstand. Der grüne Unterstützungsbereich wurde in Form einer klassischen Bärenfalle nur kurzzeitig unterboten. Viele Anleger haben in diesem Zeitraum ihre Positionen gegeben und kommen nun - unterinvestiert - ständig weiter unter Performancedruck. Ein neues Allzeithoch in den nächsten Wochen und Monaten ist sehr wahrscheinlich.

Dow Jones Monatschart

Den Monatschart werten wir derzeit eindeutig bullish. Der große Bärenmarkt der Jahre 2000 bis 2002 ist im langfristigen Kontext nicht mehr als eine typische abc-Korrektur des vorangegangenen Bullenmarktes. Kurioserweise deuten noch immer viele Analysten den Anstieg seit 2002 als Bearmarketrallye und suchen händeringend nach Begründungen ihrer "Schieflage". Es werden teils haarsträubende Parallelen zu Anfang 2000 bzw. zum Herbst 2000 gezogen. Hier scheint eher der Wunsch Vater der Gedanken zu sein. Wir gehen weiterhin davon aus, dass wir uns in einem neuen Bullenmarkt befinden. Die "endgültigen" Kursziele der laufenden Aufwärtsbewegung sollten wir längst noch nicht gesehen haben. So lange in jeder Korrektur die Angst der Investoren so schnell ansteigt, sind echte Trendwenden und ein neuer Bärenmarkt tendenziell unwahrscheinlich.

Fazit

<! p align=justify>Verfolgen Sie in den nächsten Tagen die Medien. Umso mehr Kommentare vor einem schwachen September warnen, desto unwahrscheinlicher wird eine deutliche Korrektur in den nächsten Wochen.

Autor: Thomas Grüner

Gruß Moya

Nach Ansicht der Landesbank Rheinland-Pfalz (LRP) richtet sich der Blick der Anleger in der kommenden Woche angesichts weniger Unternehmenstermine eher auf Konjunkturdaten aus den USA. 'Da allerdings auch der US-Makro-Kalender nur sehr spärlich gefüllt ist, dürfte sich das Weltbild auf Wochensicht kaum entscheidend verschieben', sagt LRP-Marktstratege Michael Köhler.

Die nachlassenden Zinssorgen stünden Befürchtungen einer stärkeren konjunkturellen Abschwächung auf der anderen Seite gegenüber. 'Als einer der wenigen potenziellen 'Market Mover' ist weiterhin der Ölpreis einzustufen, je nachdem, in welche Richtung das Pendel an der psychologischen Schwelle von 70 US-Dollar je Barrel ausschlägt', sagt Köhler.

RUHIGER WOCHENAUFTAKT ERWARTET

Angesichts mangelnder Vorgaben aus den USA am Montag - die Börse bleibt wegen des Feiertages 'Labor Day' geschlossen - wird der Wochenauftakt in Deutschland besonders ruhig ausfallen und von geringen Umsätzen geprägt sein. Wer der Statistik glaubt, der wird auch in den kommenden Wochen nicht viel Bewegung erwarten - immerhin gilt der September Berechnungen zufolge als der schwächste Börsenmonat. 'Längerfristig orientierte Investoren sollte dies aber nicht abschrecken, denn treibende Faktoren wie steigende Unternehmensgewinne sind intakt', schreibt die Landesbank Baden-Württemberg.

In Italien wird am Montag Banca Intesa Zahlen vorlegen. Neue Details zur Fusion mit der Turiner Großbank Sanpaolo IMI sind nach Ansicht von Experten nicht zu erwarten.

ARBEITSKREIS AKTIENINDIZES ENTSCHEIDET AM DIENSTAG

Am Dienstag steht das Treffen des Arbeitskreises Aktienindizes auf dem Programm. Aus Sicht der Hypo Vereinsbank ist die Frage um den Einstig in den Leitindex DAX so gut wie geklärt. 'Nach unseren Simulationen ist es die Postbank, die das Rennen macht', meint Marktstratege Christian Stocker und bekommt Unterstützung von der DZ Bank, die die Postbank ebenfalls vor dem Darmstädter Pharma- und Spezialchemiekonzern sieht. Absteiger ist nach der Übernahme durch Bayer der Pharmakonzern Schering . Am 18. September tritt die Änderung im DAX dann in Kraft.

Am Donnerstag wir der Energie- und Versorgerkonzern Suez in Frankreich Zahlen für das Halbjahr veröffentlichen. Anleger hoffen auf neue Informationen zu der geplanten Fusion mit dem Gasversorger Gaz de Franze (GDF). Auf der Konjunkturseite stehen die Einkaufsmanagerindizes für den Dienstleistungssektor (Dienstag Europa und Mittwoch USA) auf dem Terminzettel. Zudem werden die Auftragseingänge für das verarbeitende Gewerbe (Mittwoch) und die Produktion im verarbeitenden Gewerbe (Donnerstag) bekannt gegeben. In den USA veröffentlicht die Notenbank am Mittwoch das Beige Book, ihren monatlichen Konjunkturbericht./sc/fat/sbi

--- Von Nadine Schwede, dpa-AFX ---

Mit einem Kurssprung in der Eröffnung und einem bisherigen Kursplus von 1,38 Prozent, überwand heute Morgen der japanische Nikkei 225 seine charttechnische Hürde bei 16244 und nahm damit seinen sekundären Aufwärtstrend (gültig seit Juli) wieder auf. Die nächst höhere Hürde wäre nun der Bereich um 16750, ein orientativer Widerstand, hergeleitet aus der ursprünglich unteren Bereichsbegrenzung vom zweiten Quartal letzten Jahres.

Der hongkonger HSI beeindruckt ebenfalls mit einem kräftigen Aufschwung und notiert aktuell in unmittelbarer Nähe seines, bereits im August markierten Mehrjahreshochs und erreichte damit das, in der Vorwoche (nach Bestätigung der aktuell gültigen Trendbegrenzungslinie) definierte Kurs-Ziel. Unter Trading-Gesichtspunkten kann nun die empfohlene Long-Position geschlossen oder zumindest durch eine engmaschige Stop-Kursanpassung abgesichert werden.

Diese positive Entwicklung der asiatischen Aktien-Indizes ist heute Morgen als Nachklang auf den Kursschub in den US-Märkten vom Freitag zu sehen, die überwiegend positiv auf die veröffentlichten US-Wirtschaftszahlen reagierten. Sowohl die Arbeitsmarktdaten, als auch die Verbraucherstimmung und die Bauausgaben stützten das Sentiment, so dass hier erneut Argumente für eine Fortsetzung der Zinspause gesehen wurden. Im Ergebnis lösten sich Dow Jones und S&P 500 Index nun nachhaltig von ihren jüngsten Zwischenkonsolidierungen nach oben hin ab und setzen somit ihren seit Mitte Juli gültigen Aufwärtstrend in Richtung ihrer Jahreshochs fort. Als nächst höher liegende potentielle Kurs-Ziele definieren sich die Bereiche um 1326 im S&P 500 Index, sowie 11670 im Dow Jones.

Beide NASDAQ´s erreichten in der Vorwoche ihre charttechnischen Widerstände um 1585 / 1590 (NASDAQ 100) bzw. 2190 (NASDAQ Comp.). Am Freitag, in Folge der allgemein positiven Stimmung in den USA, drangen die Kursverläufe beider Indizes in diese Widerstandszonen ein und stellen Sie aktuell zur Disposition.

Aus markttechnischer Sicht, werden sowohl in den US-Standardwerte-Indizes, als auch in den beiden Wachstumswerte-Indizes die laufenden Aufwärtstrends bestätigt.

Rentenmarkt

Einen positiven Effekt sahen wir nach der Veröffentlichung der US-Zahlen auch in der Kursentwicklung der Rentenmärkte. Der FGBL (Bund-Future), der bereits am Donnerstag mit einem beachtlichen Sprung aus der Zwischenkonsolidierung nach oben hin durchstartete und die junge Widerstandszone im Bereich um 118.11 übersprang, legte am Freitag Nachmittag nach und kletterte in der Spitze bis auf 118.49. Unser strategisches Kurs-Ziel bleibt die 119, abgeleitet von dem Orientierungsniveau im Bereich um 118.86.

Als grundsätzliches Fazit für den Bund-Future können wir hervorheben, dass ein weiteres Festhalten an einer optimistischen Erwartungshaltung aus technischer Sicht unverändert gerechtfertigt ist.

....

Wir wünschen Ihnen einen erfolgreichen Handelstag !!

Uwe Wagner

Gruß Moya

Gut behauptet

--------------------------------------------------

AKTIEN

--------------------------------------------------

DEUTSCHLAND: - GUT BEHAUPTET -

Positive Vorgaben aus Übersee werden die meisten deutschen Aktien am Montag voraussichtlich antreiben. 'Die Kursgewinne in New York und Tokio werden uns helfen. Angesichts des Feiertags in den USA und nur wenigen Unternehmens- oder Konjunkturdaten gehen wir aber von einem eher ruhigen Handelstag aus', sagte ein Händler. IG Index berechnete den DAX DAX.ETR am Morgen bei 5.894 Punkten. Am Freitag war der deutsche Leitindex um 0,29 Prozent auf 5.876,54 Zähler gestiegen. Die Vorgaben sind positiv.

USA: - FESTER -

Beflügelt von einem positiv aufgenommenen US-Arbeitsmarktbericht haben die US-Börsen INDU.IND am Freitag fester geschlossen. Während die Standardwerteindizes auf den höchsten Stand seit Mitte Mai kletterten, erreichten die Indizes der technologielastigen NASDAQ-Börse neue Dreimonats-Hochs. Autowerte standen mit Absatzzahlen im Fokus.

JAPAN: - FEST -

Die Börsen in Japan haben am Montag von der guten Volage aus den USA positiv aufgenommenen Wirtschaftsdaten profitiert. Der japanische Leitindex Nikkei 225 N225.FX1 legte am Morgen rund 1,5 Prozent zu.

DAX 5.876,54 +0,29%

XDAX 5.883,49 +0,33%

EuroSTOXX 50 3.820,89 +0,32%

Stoxx50 3.536,75 +0,39%

DJIA 11.464,15 +0,73%

S&P 500 1.311,01 +0,55%

NASDAQ 100 1.589,47 +0,62%

Nikkei 225 16.370,89 +1,47% (7:15 Uhr)

--------------------------------------------------

ANLEIHEN / DEVISEN / ROHÖL

--------------------------------------------------

RENTEN: - FREUNDLICH -

Der Bund Future wird sich am Montag laut Experten in einer Spanne von 118,30 und 118,57 Punkten bewegen. 'Ein geschlossener US-Markt sowie ein leerer Kalender an marktbewegenden Neuigkeiten sprechen für Handel in enger Spanne und für eine Konsolidierung nach den deutlichen Kursgewinnen in den vergangenen Handelstagen', hieß es bei der Commerzbank. Am Freitag hatte der Bund Future 0,08 Prozent auf 118,45 Punkte zugelegt.

Bund-Future 118,45 +0,08%

T-Note-Future 107,48 +0,06%

T-Bond-Future 110,38 +0,06%

DEVISEN: - FESTER -

Der Euro hat sich im späten Handel am Freitag wieder über der Marke von 1,28 Dollar etabliert. Am Morgen in Asien Die immer gefestigtere Erwartung einer anhaltenden Pause in der Zinserhöhungspolitik der USA schwäche den Dollar, sagten Händler. Dieser gab auch zum Yen etwas nach. Am Nachmittag hatte noch der US-Arbeitsmarktbericht den Dollar kurzzeitig gestärkt.

(Alle Kurse 7:15 Uhr)

Euro/USD 1,2864 +0,19%

USD/Yen 116,45 -0,55%

Euro/Yen 149,80 -0,32%

ROHÖL: - BEHAUPTET -

Der US-Ölpreis hat sich am Montag über 69 Dollar gehalten. Der Atomkonflikt mit dem Iran bleibe weiter im Fokus der Anleger, sagten Händler. Beim Besuch des UN-Generalsekretärs Kofi Annan in Teheran am Wochenende hatte es zunächst keine Lösung gegeben.

WTI (NYMEX) 69,17 -0,02 USD (7:15 Uhr)

Gruß Moya

Erst mal n Kaffee ;o)

Wünsche allen fette Beute heute!

__________________________________________________

VIVA ARIVA!

US-Börsen weiter freundlich

Auch am Freitag begann der Handel an den amerikanischen Aktienmärkten im positiven Bereich und die Märkte konnten damit ihre freundliche Tendenz der Vortage fortsetzen. Beflügelt von einem positiv aufgenommenen Arbeitsmarktbericht kletterten die Standardwerteindizes im Verlauf auf den höchsten Stand seit Mitte Mai. Die Arbeitsmarktdaten sind mit überraschend vielen neuen Stellen und einer von 4,8 auf 4,7 Prozent gesunkenen Arbeitslosenquote etwas besser als erwartet ausgefallen. Im August war der Stellenzuwachs mit plus 128.000 etwas höher als erwartet ausgefallen. Zugleich stiegen die durchschnittlichen Stundenlöhne weniger deutlich als gedacht und bestätigten somit die Einschätzung, dass vorläufig weiterhin mit keinen Zinserhöhungen in den USA zu rechnen ist. Zudem hielt sich die Stimmung der amerikanischen Verbraucher unerwartet gut. Der entsprechende Index der Universität von Michigan sank auf 82,0 von 84,7 Punkten im Vormonat. Marktbeobachter hatten mit einem stärkeren Rückgang gerechnet. Zudem standen die Autowerte mit ihren Absatzzahlen im Fokus der Anleger. Am letzten Handelstag vor dem langen Labor-Day-Wochenende blieb der Umsatz jedoch gering. Am Ende schloss auch die technologielastige Nasdaq auf einem neuen Dreimonats-Hochs.

Gruß Moya Termine Unternehmen WKN Ereignis Autania AG 507800 Hauptversammlungen HELMA Eigenheimbau AG A0EQ5 Pressekonferenz zum Börsengang Volkswagen AG 766400 Analystenkonferenz EU Erzeugerpreise für Juli

Finde ich super und auch das Outfit ist klasse. Nun hoffe, ich, dass Alle sich hier einbringen und keine Nebenschauplätze eröffnen.

Natürlich werden wir dann auch mit weniger erwünschten Personen leben müssen, aber man kann die ja auch einfach ignorieren.

Ich wünsche Allen good trades und fette Beute

louplu

Denkt immer daran und meistens kommt es anderst......;-)

Gruß Moya Indexstand: 16.358,07 Kurs Zeit: 08:00 Veränderung:  223,82 (1,39%)

223,82 (1,39%)Letzt. Schlußk: 16.134,25 Eröffnungskurs: 16.280,18 Volumen: 0 Tagesspanne: 16.280,18 - 16.414,94 52W Spanne: 12.498,40 - 17.563,40

@treni: Wenn's langweilig wird, is der Elefant für verantwortlich...

__________________________________________________

VIVA ARIVA!

Home price data takes center stage this week

By Greg Robb, MarketWatch

Last Update: 12:05 AM ET Sep 3, 2006

WASHINGTON (MarketWatch) -- It is the classic American success story, with an economic twist. A relatively obscure economic indicator remains unnoticed only to be discovered and put on center stage and onto the lips of Wall Street traders. This rags-to-riches story fits the Office of Housing Enterprise Oversight home price index, to be released Tuesday and covering the April-June quarter.

The unknown report "is probably the best overall indicator of what is happening overall to home values. We think it is the most important number coming out next week," said David Berson, chief economist at Fannie Mae.

Home values are critical to the economic outlook. Economists disagree about how the housing slowdown will impact consumer spending. The rise in home prices has been an important driver of consumer spending. Many consumers have been refinancing their mortgages based on the higher home values and using the cash to finance purchases.

"If home price growth declines there will be less of that equity takeout and that means the economy will grow less quickly," Berson said.

On a national average basis, home sales have not fallen in any year since the late 1940s, said Berson. There have been some quarterly declines, and prices have been down annually in some regions.

Many Wall Street firms don't yet forecast the index, but the general thrust of forecasts is for the index to slowdown in the second quarter, but to remain in positive territory.

In the first quarter, OFHEO said home prices rose 12.5% in the past year and 2% from the fourth quarter to the first quarter.

"The growth rate will almost certainly be lower than they were in the first quarter," Berson said. Haseeb Ahmed, economist with JP Morgan/Chase, expects the index to decelerate to only a 2.4% annualized rate in the second quarter, the slowest pace since the third quarter of 1996. Lehman Brothers economic team expects home prices to rise at a 4% rate, the slowest pace since the second quarter of 1998. Berson forecasts home sales to drop by 10% in 2006. Housing will remain a strong market, just not as strong as the last two years, he said.

Home price appreciation will probably slow by the end of the year to the very low single digits, he said. "It is going to be a pretty big jolt in some markets, less-so in others," he said.

Wednesday is other big data day

The only other big day for data will come on Wednesday. At 8:30 a.m., the Labor Department will revise second-quarter productivity data. Economists expect overall nonfarm productivity to be revised up to a 1.5% annual rate from 1.1%. Some economists expect unit labor costs -- a key inflation gauge -- to be revised higher, although the overall consensus is for costs to remain unrevised at a 4.2% annual rate.

At 10 a.m., the Institute for Supply Management Institute will release the August non-manufacturing sentiment index. Economists look for a slight increase to 55.5% from 54.8%, with any reading over 50% showing growth.

Later that afternoon, the Federal Reserve will release its Beige Book report on business conditions through the end of August. Policymakers want to know whether the economic slowdown is gathering momentum and whether businesses are able to pass along their increased costs, which could provide momentum to inflationary pressures. They'll want to know how consumer spending was holding up as gas prices hover around $3.00 per gallon.

The Fed is expected to hold rates again at the Sept. 20 meeting, but Fed officials stress that the decision will be dependent on the incoming data.

Greg Robb is a senior reporter for MarketWatch in Washington.

Inzwischen befürchten einige Experten auch eine US-Banken/Kredit-Krise, die durch fallende Hauspreise (sinkendes Kollateral für Hypo-Kredite) ausgelöst werden könnte:

http://www.ariva.de/board/245194#jump2768653

Der Stimmungsindikator bei den US-Homebuildern (Anbieterfirmen) ist bereits stark eingebrochen:

Eight Market Spins About Housing by

Perma-Bull Spin-Doctors...And the

Reality of the Coming Ugliest Housing

Bust Ever….

Nouriel Roubini | Aug 26, 2006

My recent detailed analysis of the high risks of a housing-led recession in 2007 has

stirred some serious discussions and debates in the blogosphere and the press. Now that

the onslaught of bad news about housing (see the table below) has taken the force of a

tsunami that will soon trigger an ugly recession, Goldilocks spin-masters and perma-bulls

are on the defensive. Since the housing slump is now undeniable – and rather than a

slump it looks like a really ugly bust - the new line of defense of perma-bulls is to argue

that the problems of the housing market are only a healthy correction from bubbly

excesses, that housing is only in a modest slump that will soon bottom out and recover,

and that housing problems will not lead to wider macroeconomic troubles such a broad

recession. What a set of Delightfully Delusional Dreams that smash against the ugly

reality of recent free falling housing data shown in the table below.

The difference a year makes

Recent data quantify housing cooldown (year-over-year changes).

Builders’ sentiment -52.2%

New-home sales -21.6%

Purchase-mortgage applications -20.9%

Building permits -20.8%

Housing starts -13.3%

Existing-home sales -11.2%

Existing-home inventories +39.9%

http://www.rgemonitor.com

2

New-home inventories +22.4%

Source: MarketWatch

This free falling bust in the housing sector – that I warned about in my last paper - was

indeed colorfully depicted today by David Rosenberg and by Steve Roach, as cited in the

FT: "New home sales are now down 22 per cent year-on-year, which is a swing of

gargantuan proportion from the plus 26 per cent trend exactly a year ago - this is the

weakest trend in a decade," said David Rosenberg, North American economist at Merrill

Lynch. "The only thing 'orderly' out there right now is the guy carrying the stretcher."

Stephen Roach, chief economist at Morgan Stanley, added: "America's housing bubble

finally appears to be bursting." He said a post-housing bubble shakeout could take at

least two percentage points off the overall US gross domestic product growth rate.

Indeed, in a matter of months, the gravity-defying housing boom and bubble turned into

an alleged “orderly slowdown”; then, the orderly slowdown turned into a euphemistic

“soft landing”; and next, the soft landing slipped into a “slump”; most recently, the slump

worsened into a hard landing; while the latest data suggest that the hard landing recently

turned into a bust. And soon enough this housing bust will turn into a rout and an

unprecedented meltdown. To paraphrase the witty Rosenberg, soon enough the only thing

“soft” and “orderly” about the collapse of a comatose housing market will be the

undertaker carrying the coffin.

As the onslaught of data about the disorderly housing meltdown is piling up, even

evergreen perma-bulls such as the WSJ op-ed page are now in defensive and semi-panic

mode and are attacking “not-so-cool economists” (what does that is supposed to mean?

that you need to be “cool” or hip to be right? what a stupid remark from a WSJ op-ed

page that is starting to nervously sweat about the coming recession and is losing its own

well-groomed “cool”) that worry about a housing-related bust; but then, the same WSJ

op-ed page goes on to warn about the housing slump and blaming only the Fed's past

loose monetary policies for the ugly hangover from the housing bubble (more on this

below).

I have analyzed in detail in my last blog why we will soon have a housing related

recession; these views have been widely picked in the press, most prominently by Paul

Krugman in his Friday column in the NYT. While, as Krugman correctly points out, I

may be the only “well-known” economist who is arguing that we will have a housing-led

recession, many other very prominent economists – including Krugman himself as well

as Ed Leamer (who calls a soft landing scenario a “fantasy”), Jim Hamilton (see also

here) and Bob Shiller (who predicted the tech bust stock of 2000 and is now predicting a

housing bust) – are now of the view that there are serious risk of a housing market bust

that could then have macro consequences.

Then, whether this housing bust will lead to a recession or not is the only remaining

uncertainty: Krugman himself does not yet share my “certainty” - as he puts it – about a

http://www.rgemonitor.com

3

recession but, short of that certainty, he is fully of the view that the housing bust will be

“ugly” and has some risks of triggering a broader economy-wide recession. So, the

“Shrill Order of the Reality-Based Reputable Eeyores” is growing by the day and I am

proud to be in company of such distinguished academic and non-academic colleagues.

For now, since a lot of spin is being furiously spinned around – often from folks close to

real estate interests - to minimize the importance of this housing bust, it is worth to point

out a number of flawed arguments and misperception that are being peddled around. You

will hear many of these arguments over and over again in the financial pages of the

media, in sell-side research reports and in innumerous TV programs. So, be prepared to

understand this misinformation, myths and spins.

In the rest of this blog below I will thus deconstruct and unspin eight commonly heard

spin arguments on why we should not worry about the coming housing bust.

Continue reading this blog right below...

Spin #1: Housing prices are not falling, have never fallen and will not fall

Some folks are still deluding themselves that home prices have not fallen yet and that

they will not fall in the future. Indeed, since the Great Depression of the 1930 we have

not had a year-on-year fall in median home prices, as opposed to some quarters in which

home prices were falling. But now median existing home prices are only 0.9% up

relative to a year ago and new home prices are only up 0.3% relative to a year ago.

Worse, actual median home prices are falling – on a y-o-y basis - in every US region with

the exception of the South. They are even falling in the Mid-West where, allegedly, there

was not housing bubble to begin with.

Worse, as the NYT was reporting today, home sellers are now providing a variety of

financial benefits (seller paid closing costs, buyer-side realtor bonuses, and seller

subsidized mortgages, even $30K swimming pools free) that effectively reduce the price

of a sold home, even if the headline price is officially not reduced: “The typical incentive

package from a home builder consists of upgrades to the house — granite countertops

instead of humdrum tiles, stainless-steel refrigerators and stoves instead of plain white

models and wood blinds instead of plastic. At the extremes, some have thrown in $30,000

swimming pools.” Estimates of this effective price cut – via side benefits to buyers – are

in the 3% to 8% range. So, while officially median home prices are “only flat” relative to

a year ago, the effective median price has already sharply fallen. And if you were to

control for CPI price inflation – now running above 4% - home prices are even lower in

real terms relative to their nominal value. More ominously, futures contracts for home

prices predict a 5% fall in home prices in 2007, and even a larger percentage fall in a

number of key cities. It is now clear that, for the first time since the Great Depression,

even official - i.e. not fudged by side incentives and subsidies - median home prices will

be falling on a year on year basis; the typical lag in the adjustment in home prices to a

gap between supply and demand and an increase in inventories of unsold homes will be

http://www.rgemonitor.com

4

trigger for this home price bust. On a year on year basis, real home price may fall as

much as 10% or even more.

Why would prices fall so much if we have never had – since the 1930s – a year on year

fall in median home prices? The reason is clear: part of the increase in prices in the last

few years was not due to fundamentals but, rather, to a pure speculative bubble. Thus,

once this bubble bursts the reduction in speculative demand that had lead to a sharp

increase in the supply of new homes well above any fundamental demand, must need to

an actual sharp fall in the prices of the previously bubbly asset. If there had not been any

new supply response above fundamental demand, the bursting of the bubble would have

led to a smaller price response. But since the initial bubble led to a glut of new housing

whose support was only the speculative demand, the final bust requires a sharp fall in

price and this fall in price is greater than otherwise: once fundamental demand falls, the

real price of homes must be lower than before the bubble started as the increase in supply

during the bubble was much greater than the increase in fundamental demand. So, over

time the cumulative fall in home prices over the next two years may actually be very

large. And, indeed, in the most bubbly regions of the US, home prices are already starting

to fall – in real terms – at double digit levels.

Spin #2: We have never had in US history a recession that was initially triggered by

a housing bust. So, it cannot happen this time around

This spin goes in a number of varieties. One version of the argument is that housing busts

are usually the consequence of a recession triggered by other factors; i.e. it is claimed that

an exogenous shock in housing has never been the initial cause of a recession. Others

argue that the housing slump can lead to a recession only if there are other major shocks

in the economy, such as a war or oil supply shock like in 1974 or 1990. But my argument

about a housing-led recession has always been based on the fact that multiple bearish

shocks – high oil prices, the delayed effects of the increase in short and long term interest

rates, in addition to housing – have been buffeting a US consumer with falling real

wages, negative savings, falling confidence and rising debt and debt servicing ratios. So,

while the housing bust is necessary to tip over the US consumer, it is not the only factor

that will trigger the coming recession. Also, while it is true that housing may not have

been the initial trigger of a downturn in past recessions, it is also true that past recessions

– namely the one in 2001 – have been triggered by an asset bubble that went bust.

In the 1990s, the tech stock bubble – in part fed by a Greenspan complaining about

“irrational exuberance” but then wimping out and doing anything about such a bubble –

led to a massive over-investment of new capital spending in tech goods (computers, IT

networks, pet.com style internet companies, internet-related capital goods, etc.). This

super-glut of capital goods first led to the tech stock bust in the Nasdaq in 2000 when it

became obvious that these investments had low returns; then it lead to a bust of real

investment in software, equipment and machinery as the massive glut of capital goods

and excess capacity led to sharply falling investment rates for four years (from 2000 until

2004) to run down such excess capacity in the economy.

http://www.rgemonitor.com

5

In the last six years a similar bubble – an even more massive one – has taken place in the

housing market and has led to a boom and bust cycle that is qualitative identical to the

tech boom and bust of the 1990s. Initially, higher and higher home prices – fed by easy

Fed policy, speculative demand and a most favorable tax treatment of housing – first led

to a price bubble, then to a sharp increase in the supply of new housing, and finally to a

glut of new homes. At the beginning of this cycle, expectations of rising prices made

speculative demand for homes even higher, in a typical bubble fashion. But eventually

you had a fall in housing demand as speculative high prices and rising interest rates (that

came too slow and too late) made the purchases of housing less affordable to many.

More recently, the growing gap between rising supply and falling demand led to an

inventory adjustment – an increase in unsold homes. Next, you had a sharp fall in the

stock prices of homebuilders – by almost 50% by now - as the demand for their new

homes started to fall and their profits started to shrink. Then, most recently the reduction

in the production of new homes – as signaled by sharply lower housing starts and

building permits – ensued as homebuilders with falling revenues and profits and lower

expected demand finally reacted to the growing glut of unsold inventories. Finally, we

are observing now the unavoidable price adjustment with an actual fall in actual housing

prices as the glut of unsold homes is now putting sharp downward pressure on actual

prices.

So, and this is a crucial point, most US recessions have been triggered by a turnaround in

real investment. In most cases this fall in investment started in non-housing sectors – and

was triggered by a variety of economic shocks - but then spread to the housing market

once the economic slowdown got underway. But in the 2000-2001 episode, the actual

initial trigger for the slowdown was not a severe monetary tightening (even if the Fed did

hike interest rates by 175bps between 1999 and 2000) or a severe oil shock (even if oil

prices rose from low teens to high teens in 2000): it was rather the bursting of the bubble

and the bust of the tech sector – first the stocks, then the real investment – that led to the

recession. So, bubble cycles can and do lead to booms and busts that then cause

recessions – in the US and abroad. The reaction of the Fed to the tech bust of 2000-2001

then generated the housing bubble of the last five years in a new cycle of boom and bust.

So, the crucial point is not whether exogenous shocks to housing have ever led to a

recession: the crucial point is that recessions triggered by bursting assets bubbles have

occurred – most recently in 2000-2001 and will occur again this year as the housing

bubble is imploding.

In a previous longish paper (“Why Central Banks Should Burst Bubbles”) and other

writings, I have analyzed and criticized in detail the asymmetric Fed approach to asset

bubbles that is the source of these booms and busts. In the view of Greenspan, Bernanke

and Kohn the Fed should never target asset prices and should not try to prick an asset

bubble for two reasons: you are not sure there is a bubble in the first place; and trying to

prick an asset bubble is like attempting to perform “neurosurgery with a sledgehammer”,

i.e. the treatment will always be too harsh and kill the patient, i.e. economy. Thus, the

Greenspan-Bernanke view is that you do nothing when bubbles fester on the way up and

then you aggressively ease monetary policy when bubbles burst, since such falling

bubbles risk to cause severe real, not just financial, damage to the economy. This

asymmetry is the source of the Greenspan-Bernanke “put” and the moral hazard that this

http://www.rgemonitor.com

6

asymmetric insurance has created in financial markets: let bubbles fester on the way up,

do nothing about them and then pick up the debris and shelter investors from the free fall

when the bubbles burst. Speak about moral hazard. This is what happened in the tech

cycle of the 1990s and the same bubble cycle was created in the last few years in the

housing market. We will now see whether Bernanke will try to rescue the housing market

with aggressive Fed easing. Certainly, the next Fed move will be a cut when – in the fall

or winter - the signals of a US recession become even stronger than they are now.

Unfortunately, the Fed is running out of bubbles to be created and allowed to fester.

Thus, the “not-so-cool” but “perma-bull” WSJ op-ed page has it partly right and mostly

wrong: right in pointing out that the housing bubble was in part triggered by the Fed

easing too much and for too long and starting to tighten too little and too late. Mostly

wrong because: a) it supports the now flawed view that the Fed should not target asset

prices while sounding the usual and tired gold-bug style alarms about the risks of

inflation that are allegedly priced into the high asset prices of a barbaric relic such as

gold; b) it has been pushing the Fed to keep on tightening monetary policy now when the

coming recession will already reduce inflation; c) deluding itself in believing that a

recession is now avoidable, even more so if the Fed were to follow the senseless advice

of the WSJ and keep on raising the Fed Funds rate when the economy is spinning into a

recession. <>So, in summary, it is a spin to argue that housing alone cannot trigger a

recession. The tech bubble and bust did trigger a recession in 2001; and the housing

bubble and bust will trigger a deeper and nastier recession next year than the one in 2001:

as I have analyzed in detail in previous writings the effects of the housing bust will be

more severe and intense than those of the tech bust because the aggregate demand, wealth

and employment effects of housing are much larger than those of the tech sector. So, this

will indeed be the first housing-led recession and the second-in-a-row bubble-led

recession in six years. Also, as in all the US recessions since 1973, this investment bust –

in most cases first in non-residential investment and consumer durables – in this case first

in residential investment and consumer durables – will be the combination of three

similar factors: 1. shocks that hit investment, be it bubbles or other factors; 2. a monetary

tightening; 3. an oil shock. This has been the pattern in every recession since the 1970s

and it will be the same pattern in the recession of 2007.

Spin #3: In spite of the housing slump, the levels of activity in the housing market

are still very high relative to a few years ago. So, there is no housing bust, only a

healthy correction.

Whenever I present on TV my views on a housing-led recession there is a pundit or

anchorman or guest expert that shows a few colorful charts of the housing markets and

spins: “Yes the housing market is correcting and housing starts and sales and all other

indicators are now falling BUT they are falling from very high levels; for example,

housing starts are still in the millions! LOOK: all these indicators were sharply rising

year after year and now they are only softening downwards; their absolute level is still

high relative to three or four years ago! SO, this is only a healthy adjustment from some

modest excesses!”

http://www.rgemonitor.com

7

These arguments are total nonsense for various reasons: 1. if an indicator that is at a high

level is falling at an annualized rate of 10, 20 or 30% - as many housing indicators are

now - there is still a housing bust regardless of the previous level: when first and second

derivatives show an accelerating fall, this is a bust and levels may, in due time, go back to

the previous lower level of a few years ago. 2. in a rising economy where economic

growth is positive, every real economic indicators heads up over time given the trend

growth of the economy: GDP, employment, consumption, real estate data, etc., they all

do. So, every economic time series looks like a rising chart given the underlying trend in

the economy: if you chart GDP over the last 60 years you see a straight line up where you

can barely notice – only by using a magnifying lens – the dozen or so recessions that did

occur during that period. Indeed, in a long term chart of the level of GDP these recessions

look like barely noticeable ripples in a increasing line. Still, when you get a recession

GDP falls and that fall – however short – is ugly and painful for jobs, incomes and the

economy. <>So, saying that housing indicators – while now sharply falling - are still

high or higher than previous levels is spin: of course they are still higher as long run

economic growth, demographic change with population growth and migration and a big

huge bubble for the last decade made them go higher and higher for years for

fundamental and non-fundamental reasons. Leaving aside periods of housing busts (and

we have had many of these busts in the last 60 years), the direction of all housing

indicators – like any economic indicator - is an upward trend line. Thus, even after we

had a nasty housing bust this year and next year, the level of housing indicators will be

higher than they were in 2000 or 1990 or 1980 or 1970 as you got trend growth and trend

population growth; this is basic Economics 101 that I teach daily to my students. And, as

any student of Economics 101 well knows, what matters for busts and recessions – when

you have trend growth - is not the level of a variable compared to past historical levels:

what matters is the direction of change: a protracted fall in the level of a variable

represents a bust in that sector and, if that bust is at the aggregate level, you call that a

recession.

Jim Hamilton at Econobrowser takes on the same spin arguments about the level of

activity in housing still being high in spite of the recent falls. He says: “Dave Altig at

Macroblog [1], [2], another source that's always worth reading, thinks the gloom and

doom has been overdone. Dave notes that even with a drop back to 2003 levels, home

sales per person are still at historically high levels, a point also noted by Bizzyblog and

some Econbrowser readers. I must say that I don't take much comfort in that. The bigger

the preceding surge in construction, the bigger the overhang that might now have to be

worked off. I certainly don't see much in the historical record to suggest that the more

dramatic the prior boom, the more modest was the subsequent bust. Just the opposite--

1929 (the year the Great Depression began) started out as a tremendous boom, as did

1973, which preceded the biggest U.S. recession since World War II.”

In summary, beware of misleading charts and arguments allegedly showing that housing

indicators are still at high levels, even when the tail of these charts looks like a free

falling death-defying sky slope with a slope close to 90 degrees.

http://www.rgemonitor.com

8

Spin #4: If the housing bust gets ugly, the Fed will ease rates and rescue us from a

recession.

This spin-masterful wishful dream pins its hope on the Fed coming and rescuing the

economy from a recession if the housing bust were to affect the broader economy.

Indeed, as I have been arguing from an out-of-consensus line, the next move by the Fed –

this fall or winter – will certainly be a Fed Funds cut, certainly not an increase. This cut

will be triggered by signals that the economy is experiencing a hard landing and risking a

serious recession. Indeed, even before such a cut, the changed market mood about the

Fed next actions – so far a change in expectations from a Fed “pause” to a full “stop” –

has already led to a meaningful reduction in US long rates and in mortgage rates that

could, in principle, dampen the recession risks.

However, as I have argued before, such Fed easing will not rescue the housing market

and will not rescue the economy from a now unavoidable recession. The Fed easing will

not prevent a recession for the same reasons why the Fed pause and easing in 2000-2001

did not rescue the collapse in investment in the tech sector. The reasons why the Fed

cannot rescue housing and the economy are clear. First, Fed policy in 2001-2004 fed an

unsustainable housing bubble in the same way in which the Fed policy in the 1990s fed

the tech bubble. Now, like then, it payback time: with huge excess capacity in housing

(then in tech capital capacity) even much lower short and long rates will not make much

of a difference to housing demand. Real investment fell by 4% of GDP between 2000 and

2004 in spite of the Fed slashing the Fed Funds rate from 6.5% to 1.0%. Does anyone

believe or can show that a 50bps or even 100bps easing by the Fed will undo the housing

investment bust that is coming in the next two years? No realistic way: when there is a

glut of excess supply of capital goods or housing stock or consumer durables, the demand

for such durable consumption or investment becomes interest-rate insensitive. When

there is a glut of capital goods or consumer durables or housing as there is one now,

easing monetary policy becomes ineffective as it is like pushing on the proverbial string.

Second, a Fed easing in the fall may be too small - at most 50bps cut by Q1 of 2007 - and

will have too little of an effect on long rates to be able to affect the debt servicing ratios

of debt over-burdened households. Also, long rates will not be affected much by a Fed

ease for the same reasons – the global conditions that determined the 2004-2005 “bond

conundrum” – why a Fed tightening did not affect long rates in the recent experience.

Some easing by the Fed will have a little downward effect on long rates; indeed, long

rates have recently fallen as markets have started to price in the fact that the Fed is done

with tightening. But, if inflation were to actually rise further because of oil and other

stagflationary shocks, long rates may actually go up if an excessive Fed easing would

likely cause increases in long term inflation expectations. Since we are still facing

potentially stagflationary shocks, while the Fed will cut the Fed Funds rate during the

coming hard landing, the Fed can ill afford to ease too much as too much easing will be

counterproductive for bond rates and for housing. Thus either way households, burdened

with ARMs and overburdened with increasing housing debt at the time when housing

prices are slumping and now falling, can expect little relief from lower short rates or long

rates. The Fed just cannot rescue housing; it can only very modestly dampen its

protracted multi-year free fall.

http://www.rgemonitor.com

9

Indeed, in 2000 the Fed stopped tightening in June 2000 (after a 175bps hike between

June 1999 and June 2000). That early pause/stop did not prevent the economy from

slowing down from 5% plus growth in Q2 2000 to close to 0% growth in Q4 2000. Also,

the Fed started to aggressively ease rates – in between meetings in January 2001 – when

it dawned on the FOMC that they had totally miscalculated the H2 2000 slowdown (they

were worrying about rising inflation more than about slowing growth until November

2000 when it was too late). And this aggressive easing in 2001 did not prevent the

economy from spinning into a recession by Q1 of 2001. This time around you will get

into the same pattern: today’s 5.25% Fed Funds rate reflects the effects on the economy

of a Fed Funds rate closer to 4% given the lags in monetary policy and the effects of past

tightenings in the “pipeline” (as Bernanke and Yellen put it recently). So, pausing or

stopping now will not help (like the June 2000 pause/stop did not help) and easing in the

fall will be too late, in the same way in which the aggressive easing in early 2001 did not

help.

Spin #5: Credit conditions in the housing market are not tight. Credit growth is still

perky and there is no credit crunch. So, unlike the past, there will be no hard

landing

A further spin is the argument that a housing bust and a wider economy-wide recession

requires tight credit conditions, while current credit conditions, in the housing market and

more generally in the economy, are not that tight. It is true that past recession have been

usually caused – in part – by a sharp tightening in monetary policy and tighter credit

conditions: the Fed tightened by 175bps between 1999 and 2000 for example; by that

standard, the current 425bps tightening by the Fed in the last two years is larger even if,

of course, what matters is the level of nominal – or even better – real interest rates.

Using a core measure of inflation, real rates are not so low for borrowers – even in

comparison to conditions in 2000. And for homebuilders now facing falling prices of the

goods they are selling – i.e. homes – the real borrowing rate is now extremely high as

home prices are now falling. Thus, the reduction in the real price of housing is a severe

credit crunch for homebuilders and contractors who are facing a fall in the relative price

of what they are selling at a time when there is a glut of new homes: no wonder that

building permits housing starts are in free fall (-21% and -13% respectively relative to a

year ago).

More importantly, you do not need a credit crunch in order to get an investment bust; if

an investment bubble has led to an excess supply of an real asset relative to its

fundamental demand, eventually the bursting of such a bubble will lead to a fall in the

speculative and fundamental demand for such an asset, regardless of a credit crunch: a

modest monetary tightening is enough to burst such a late-stage bubble (a bubble at the

late stage when overpricing is so excessive that small shocks are enough to prick the

bubble) and trigger a sharp fall in the real investment in such a capital good. The perfect

example was 2000-2001 when a 175bps tightening by the Fed between June 1999 and

June 2000 was enough to first prick and then burst a tech stock price bubble – that had

http://www.rgemonitor.com

10

led to the overinvestment in tech capital goods - and lead to a sharp fall in real investment

(by 4% of GDP between 2000 and 2004). The same is happening now with housing: the

425bps tightening by the Fed has finally burst an overinflated housing bubble that was

getting out of control with ever rising rate of increase of housing prices.

The crucial conceptual point - that is essential to understand why the housing bust will

lead to an economy-wide recession - is that it is not necessary to have a severe monetary

tightening or a severe credit crunch in order to have the bus of an investment boom that

was initially triggered by easy money and an unsustainable bubble. Once a modest

monetary tightening - or any other shock that prick the bubble - does occurs, the

investment bust can occur even without a credit crunch. That is what happened in 2000-

2001 with the tech stocks and the tech goods real investment; and that is what is

happening today with the bursting of the housing bubble.

In other terms, a housing-led recession can well occur even without a credit crunch. In

the case of a bursting bubble, the demand for credit – rather than the supply of credit – is

most important and a reduction in the demand for credit can be associated with a bust.

Indeed, recent lending indicators - both for housing and consumer loans - are also headed

south. While the supply of credit is not getting tighter based on recent surveys, the

demand for credit by firms and households is sharply slowing. Of course, the slowdown

in the demand for home mortgages is related to the housing slump. But now you are also

seeing lower demand for C&I loans; this suggests that investment spending may be

falling ahead, as already signaled by Q2 data on real investment in equipment and

software. The fall in the demand – rather than the supply - of mortgage financing is also

very clear in the data: while overall mortgage applications are still up in the latest figures

published this past week, due to sustained refinancing applications, applications for

purchase applications have fallen 1.0% during the last week, for the fifth time in the last

six weeks. Moreover, there is a large amount of evidence that suggests increasing

cancellations of initial mortgage applications, as the slump in the housing market and in

the economy is now scaring households considering buying a home. Thus, the official

data on purchase mortgage applications are very likely to exceed actual home sales as

cancellations increase over time.

Also, note that the demand for home equity withdrawal (HEW) will be sharply down

soon enough as the housing price flattening is turning into an outright fall in average

housing prices (as such prices already falling in most of the U.S. regions). And with

lessened HEW, the ability of households with negative savings to consume more than

their incomes - as they have been doing for two years with negative savings - will be

severely curtailed.

Finally note that, soon enough, credit conditions in the housing markets will become

tighter as an increasing number of homeowners – pinched by falling home prices, rising

mortgage servicing obligations and weak income growth - will be unable to service their

mortgages and will end up defaulting on them. Indeed, H&R Block stock price plunged

on Friday by 8.7% on news of large losses and loan liabilities related to rising mortgage

delinquencies at its Option One Mortgage unit: the problems result from an increase in

http://www.rgemonitor.com

11

mortgage customers who have fallen behind on loan payments. Not surprisingly, other

sub-prime mortgage lenders’ stock prices got a beating on Friday following the H&R

Block news and the news that a California home lender reported higher default rates.

These news are ominous as the housing bust will very soon lead to a sharp increase in

default rates on mortgages (see more on this below) and will, in short order, lead to a

credit crunch in the housing market. Thus, while until now there has been no credit

crunch and most of the action has come from a falling demand for housing credit, once

default rates start to skyrocket - and they will soon – you can expect a widespread credit

crunch in the housing sector that – like in the late 1980s – may eventually spread to the

rest of the economy. Indeed, there is a meaningful risk that – like in the S&L crisis of the

1980s – the housing bust will lead to the collapse of a large number of mortgage finance

institutions and a broad banking crisis (more on this risk below).

Spin #6: Given the increase in housing prices there is still so much net wealth

(equity) in the housing sector that most households are richer, will keep on feeling

richer and will keep on spending more.

The “there is still trillions of untapped equity in housing” spin goes along the following

lines: “Doom & Gloom Eeyores worry about all the debt – now well above their incomes

- that households have been piling up in the last few year with new mortgages,

refinancing and consumer credit but, in spite of this larger debt, the increase in the value

of their housing, has led to a sharp increase in households’ net wealth; so, there is still

tons of untapped equity in housing and this untapped wealth will support home equity

withdrawal and consumption; so there is little risk that the housing bust will lead to a

consumption bust and a recession”

This spin can be deconstructed in many ways. First, is the increase in housing prices a

true positive wealth effect? Or just a factor that leads to a loosening of the credit

constraints that then allows households to use their homes as an ATM machine or as a

credit card? The wealth effects of an increase in housing values are more ambiguous than

the wealth effects of capital gains on financial assets, as households also consume the

services of such housing.

An example may suffice to clarify the problem of treating housing price increases as a

true wealth increase. I bought a loft in downtown NYC three years ago whose value has

gone up by 125% (an exact figure – not a guess- as it is based on the recent purchase of

an identical loft above me by a celebrity). Do I feel richer and should I consume more as

I am wealthier by 125%? The simple answer in no: if I wanted to cash the capital gain I

would have to sell the loft and buy another one with the same amenities and features; but

I will be paying the same higher price for the new loft to get the same housing services;

so no wealth effect. So, I am not wealthier in spite of a lofty 125% alleged “capital gain”:

what has happened is that the price of my consumption of housing services has increased

by 125% in the last three years; I am not richer: I am just paying more for the same

housing services in my now overpriced loft.

http://www.rgemonitor.com

12

There are two counter-arguments to my argument that rising home price are not a true

positive wealth effect. First: “You could sell at the high current price, move to Idaho, buy

a much cheaper home and enjoy the capital gain; so you are richer!” Of course, that

counter-argument is nonsense: I want to live in NYC and enjoy the amenities of this city

life; so I am paying more for my housing service when the value of my loft goes up; I am

not richer. Indeed, the recent sharp increase in “owner equivalent rent” – after years in

which this contribution to CPI inflation was biased downward – is a reflection of the fact

that - as home prices have skyrocketed and made housing unaffordable to first time

buyers and forced them to rent homes rather than buy them - now rents are rising and this

implicit increase in the real prices of housing services is, finally, correctly reflected in our

CPI measure of inflation.

Second counter-argument: “If home prices are so high relative to rents – and indeed the

home price rental ratio was sharply up in the last few bubbly years – you should sell, rent

a home with similar features and then enjoy the capital gain; so you are indeed riche!r”

This argument is also flawed in many ways: a) it is true that many non-owners who could

not afford the crazy and rising home prices of the last few years have decided to rent

rather than buy and this is now pushing rental prices sharply higher; so the disequilibrium

in the relative returns and costs between owning and renting is now shrinking as rents are

adjusting upward; so this ownership-renting arbitrage is disapperaing; b) it is hard to find

for rental a home with the same amenities and features of a home that you purchase; c)

there are a lot of sunk costs involved in owning a home and thus selling and moving to

rental does not make sense: home ownership has psychic benefits and it also has positive

social externalities’ benefits that many studies suggest; also, buying a home includes

investing a lot in home-specific durable good purchases (furniture, home appliances,

décor and design of a home) that are not easily and costlessly transferable to a rented

unit. So, in practice – given all these sunk costs and benefits of owning - almost all of the

homeowners do not sell and move to rentals when the home-price to rental ratio is in

disequilibrium and out of line. They rather pay a higher price for their consumption of

housing services. So, they are not richer: in some sense, they are poorer as they are

paying more for the consumption of the same housing services.

Of course, I do not want to argue that all increases in housing wealth coming from an

increase in home prices are not a true wealth increase. Some of it may be truly perceived

and be an increase in net worth; I am just saying that it is not conceptually so clear that

most of it is a true positive wealth effect as housing is an asset whose return is

represented by the consumption of its own services. Also, some older households

eventually retire and go to cheaper housing location or sell and downsize the size of their

home to a smaller one when their children have left home; so they can benefit of some of

the capital gain. But for many households – including myself – the recent increase in

housing prices is not a true increase in wealth.

So, the next question becomes: why would households borrow so much more – as they

have done in recent years - against their increased housing wealth when home prices go

up – and spend it on consumption - if most of this price increase is not a “true” wealth

effect? The answer is twofold: first, there may be some degree of wealth illusion and

some households that downsize are actually able to benefit from a “true” capital gain;

http://www.rgemonitor.com

13

second, even if a household is not truly wealthier, a paper increase in the value of the

home allows a households to reduce its credit constraint in the capital market: i.e. a

household is able to borrow more against this alleged increased “home equity”. So, what

an increase in home prices does it to loosen the credit constraints of households, both

how much they can borrow as well as the interest rate at which they can borrow as the

collateral of housing wealth reduces the cost of such borrowing relative to the cost of

uncollateralized borrowing (say credit card debt).

Thus, households that are credit constrained and whose incomes are not rising fast

enough to keep up with their increased consumption patterns re increasingly borrowing to

be able to keep on spending above their incomes. Indeed, as households’ savings rates

having been negative for the last two years the only way households could consume more

than their incomes was to use their homes as their ATM machines, i.e. running their debts

via refinancing and other increases in consumer debt. Note that running down assets

rather than increasing debt – to finance an excess of consumption over income - does not

work for most US households as their liquid assets are small and as most their assets are

in highly illiquid forms (housing and investments in 401k plans and other retirement

savings plans that – given their tax-deferral advantages – are effectively highly illiquid).

Indeed, in 2005 out of the $800 billion of Home Equity Withdrawal (HEW) at least $150

or possibly $200 billion was spent on consumption and another good $100 billion plus

went into residential investment (i.e. house capital improvements/expansions). The rest

of it was used – most likely – to manage household assets (increase buffers of liquidity)

and liabilities, i.e. reduce the stock of uncollateralized high-interest debt in exchange of

lower interest rate housing-collateralized home equity loans or refinancings. But this

massive amount of recent refinancing and HEW means that it is enough for house price

to flatten, as they already have done recently, let alone start falling as they are right now

in major US housing markets, for the wealth effect to shrink and for the ability to borrow

to be reduced; then, the HEW will dribble down to much lower levels than in the recent

past and consumption growth will sharply fall and possibly stall.

Would the fact that households still have a large amount of untapped housing wealth

untapped imply that they can and want to further withdraw such equity and sustain their

previous consumption patterns? No for several reasons: First, note that this year there

will be large increases in the borrowing costs for $1 trillion of ARMs that will be repriced

and this figure for 2007 will be $1.8 trillion. As short-term interest rates have

sharply increased in the last two years, this repricing of low interest rate ARMs will

imply sharply increasing payments on past mortgages and refinancing loans. Thus, debt

servicing costs for millions of homeowners will sharply increase this year and next as

$2.8 trillion of mortgages will be repriced.

Second, many households do not have much housing equity to begin with. In fact, as

recently argued by Lon Witter in Barrons (hat tip to Ritholtz for this), 32.6% of new

mortgages and home-equity loans in 2005 were interest rate only, up from a figure of

0.6% in 2000; 43% of all first-time home buyers in 2005 put no money down and thus

http://www.rgemonitor.com

14

had no initial equity in their homes; 15.2% of 2005 buyers owe at least 10% more than

their home is worth (in other terms they have negative equity); and 10% of all home

owners with mortgages have no equity in their homes (in other terms, they have zero

equity).

Moreover, the expected fall in home prices that is currently occurring implies that the

existing home equity is actually shrinking over time. Worse, a combination of increased

debt, increased interest rates on these home mortgages, falling real wages – especially for

poorer households – and shrinking home equity (that for many may actually mean

negative equity) will imply that it will become increasingly hard for millions of

households to service their mortgages. Many of these households will end up defaulting

on such mortgages and thus be subject to foreclosure of their homes. Notice that for

households with negative home equity that are unable to service their debt obligations it

is a rational choice to default as the costs of default will become smaller than the benefits

of continuing to service a liability on an asset for which they have negative equity. So,

the likelihood of default by households with negative home equity will be large.

But even households with positive but low amounts of home equity may decide to default

if they cannot service the increased payments on their mortgages: these households may

become liquidity constrained when low income and increasing debt servicing on the

principal and interest on the mortgage produces a binding credit constraint. Ability to

refinance or extract equity at low interest rates will disappear and, only under conditions

of financial distress and near default, some households may be able to restructure their

mortgage liabilities and avoid outright default and foreclosure. Either way it will be very

ugly for millions of households who will outright default or restructure their debt

obligations. And the increases in delinquencies that H&R Block and other sub-prime

mortgage lender are already observing now is only the tip of this delinquency iceberg that

will become much worse when the economy slows down further and falls into an outright

recession. Note that you do not need a fully fledged recession to have this severe

pressure and rising delinquencies: a growth slowdown and rising debt obligations will be

enough to tip over the cliff millions of weaker mortgage borrowers. Moreover, with the

recent changes in personal bankruptcy laws, that make it more painful for individuals to

default, the negative income and consumption effects of default will be more severe: the

new law – by making the costs of default higher – will leave defaulting households

poorer and with less resources for consumption. Thus, the consumption and demand hit

from default will be more severe than in the past.

Note also that, even for households with meaningful amounts of untapped home equity,

the slowdown and then outright fall in home prices together with higher debt servicing

ratios and flat or falling real wages and negative savings, the ability and willingness to

further extract home equity will sharply shrink. Indeed, for US households to continue to

consume at a rate that is 2% higher than their incomes – as they have done on average

since 2005 - implies a significant persistent reduction over time of their remaining home

equity; obviously, this Ponzi game of running down one’s own assets to finance an

excess of consumption over income cannot go on forever and is not even a optimal path

that rational households will take. More rationally, with the housing bust and falling

prices, households are been pinched by a negative wealth effect and are starting to cut

http://www.rgemonitor.com

15

back on consumption and reduce the rate at which they are dissaving. Indeed, based on

the experience of countries such as the UK, Australia and New Zealand, it is enough for

home prices inflation to slow down – let alone to outright fall as they are now in the US –

for HEW to sharply fall. And since household savings in the US are negative – unlike the

US, Australia and New Zealand – this sharp slowdown in HEW will have much more

severe effects on consumption than in the other countries where the fall in HEW did

indeed lead to a sharp slowdown – but not outright fall - in consumption.

Thus, the coming US housing bust and fall in home prices will have a significant and

severe effect on consumption and will be a key transmission factor that will trigger a

broader consumption retrenchment and a recession.

Spin #7: Banks and mortgage lender are still very sound and there is no risk of

systemic banking crisis.

The other spin that one hears over and over again is that, unlike the 1980s when we had a

systemic banking crisis (the famous Savings & Loans (S&L) crisis) today banks and

mortgage finance institutions are very sound and with low delinquency rates: default rates

on mortgages are still low if rising.

The reality is quite different and much uglier: the housing bubble of the last few years

may have planted the seeds of another nasty systemic banking crisis that could be more

severe and costly than the S&L crisis of the late 1980s. First, notice that the housing

boom of the last few years has led to a credit boom that is quite unprecedented for the US

in recent history. Credit boom and excessive overlending episodes – based on cross

country experience – often lead to credit busts that cause both banking and financial

crises as well as economic recessions.

Second, not only we have had in the last few years a massive credit boom associated with

the debt financing of the housing bubble; this lending boom has also been associated with

an extreme loosening of credit standards that allowed the boom to continue and feed an

ever more unsustainable housing bubble. Indeed, many mortgage lenders have gambled

for redemption during the bubble years and engaged in extremely risky and reckless

lending practices that may eventually lead to financial distress, or even their outright

bankruptcy; we may be soon facing the same mess and systemic banking crisis that we

had in the 1980s with the S&L crisis. The lending practices of mortgage lenders became

increasingly reckless in the last few years: indeed, in 2005 a good third of all new

mortgages and home equity loans became interest rate only; over 40% of all first-time

home buyer were putting no money down; at least 15% of buyers had negative equity;

and an increasing fraction of mortgage came with negative amortization (i.e. debt service

payments were not covering interest charges, so the shortfall was added to principal in a

Ponzi game of accumulating debt). Finally, at least 10% of all home owners with

mortgages currently have zero equity.

http://www.rgemonitor.com

16

This reckless lending scam was fed by ever loosening lending standards, the massive

growth of sub-prime lending and over-inflated valuations of homes to justify new

mortgages and refinancings (when significant equity extraction was occurring). It was a

vast and growing lending scam where lenders’ behavior was distorted by serious moral

hazard incentives driven by poorly priced deposit insurance, lax supervision of lending

practices by regulatory and supervisory authorities, slipping capital adequacy ratios, toobig-

to-fail distortions and the distortions created by the financing activities of the too-bigto-

fail government sponsored enterprises (Fannie Mae and Freddie Mac). Indeed, you can

expect the WSJ op-ed page soon to blame the entire coming housing and banking crisis

on the activities of these GSE’s (on top of blaming on the Greenspan and Bernanke put).

Citing the recent article by Lon Witter in Barrons, Barry Ritholtz clearly describes the

reckless lending practices of many lenders:

Traditionally, Mortgages have been low risk lending, as the loan is securitized by the

underlying property. When banks were lending less than the value of the property (LTV),

to people with good credit, who also were invested in the property (substantial down

payments) you had the makings of a very good business: low risk, moderate, predictable

returns, minimal defaults. That model seems to have been forgotten. THIS IS

REMINSCENT OF THE S&L CRISIS -- where lenders did not have any repercussions for

their bad loans!

As bad as the above numbers look, the thinking behind them is worse:

"Lenders have encouraged people to use the appreciation in value of their houses as

collateral for an unaffordable loan, an idea similar to the junk bonds being pushed in the

late 1980s. The concept was to use the company you were taking over as collateral for

the loan you needed to take over the company in the first place. The implosion of that

idea caused the 1989 mini-crash.

Now the house is the bank's collateral for the questionable loan. But what happens if the

value of the house starts to drop?"

A good example of how this is unfolding at lending institutions comes from Washington

Mutual: You may recall Washington Mutual laid off 2500 employees in their mortgage

broker department earlier this year. As LTV went above 100%, and then as property

values decayed from recent peaks, the collateralized aspect of these mortgages suddenly

is at risk.

Here's how this has played out over the past few years via WaMu's ARM loans (data via

Washington Mutual's annual report):

http://www.rgemonitor.com

17

- 2003 year end, 1% of WaMu's option ARMS were in negative amortization (payments

were not covering interest charges, so the shortfall was added to principal).

- 2004, the percentage jumped to 21%.

- 2005, the percentage jumped again to 47%. By value of the loans, the percentage was

55%.

So each month, the borrowers' debt increases; Note there is no strict disclosure

requirement for negative amortization -- Banks do not have an affirmative obligation to

disclose this to mortgagees.

Thus, a large part of our housing system have become credit cards. And according to

Witter, "WaMu's situation is the norm, not the exception."

Even worse, Witter notes that negative amortization is booked by the banks as earnings.

"In Q1 2005, WaMu booked $25 million of negative amortization as earnings; in the

same period for 2006 the number was $203 million."

This situation is unsustainable. Witter's housing and market forecast is rather bearish:

"Negative amortization and other short-term loans on long-term assets don't work

because eventually too many borrowers are unable to pay the loans down -- or unwilling

to keep paying for an asset that has declined in value relative to their outstanding

balance. Even a relatively brief period of rising mortgage payments, rising debt and

falling home values will collapse the system. And when the housing-finance system goes,

the rest of the economy will go with it.

By the release of the August housing numbers, it should become clear that the housing

market is beginning a significant decline. When this realization hits home, investors will

finally have to confront the fact that they are gambling on people who took out nomoney-

down, interest-only, adjustable-rate mortgages at the top of the market and the

financial institutions that made those loans. The stock market should then begin a 25%-

30% decline. If the market ignores the warning signs until fall, the decline could occur in

a single week."

As Witter puts it and Ritholtz concurs, the scariest thing is that the gambling-forredemption

behavior and problems of WaMu are not the exception in the mortgage

industry; they are instead the norm. There are good reasons to believe that this is indeed

the norm as lending practices have become increasingly reckless in the go-go years of the

housing bubble and credit boom.

If this kind of behavior is – as likely – the norm, the coming housing bust may lead to a

more severe financial and banking crisis than the S&L crisis of the 1980s. The recent

increased financial problems of H&R Block and other sub-prime lending institutions may

http://www.rgemonitor.com

18

thus be the proverbial canary in the mine – or tip of the iceberg - and signal the more

severe financial distress that many housing lenders will face when the current housing