Riesiges Ölfeld in der Nordsee entdeckt

ENCORE OIL'S FUTURE

Here at STG we believe that Encore Oil will be taken out before all commercial findings will be published, we don't mean Cladhan/Catcher drills, we believe from the whispers we are hearing it will most certainly be very soon after these two Giant finds have been proven up with oil in place, Encore are a light oil explorer, Nautical Petroleum heavy oil Specialist, Between these two exceptional companies they have to be the hottest properties right now in the North Sea, Out of 16 wells drilled since 2006, EnCore has had one dry hole, made seven gas, and seven oil discoveries, and the results of one well at the Esmond field are not available. Who would bet against them striking more oil?

Encore Oil Pure Exploration Company between £4-£6 Takeover

Nautical intend to go into production, but once again we believe that Nautical will not make it that far, Drilling in the North sea has been difficult for most oil companies due to the recession and lack of funds available right now, Neither Encore/Nautical have these issues, Now oil companies are returning with oil prices in excess of $80 a Barrel and London Brent crude fetching a $2 premium to US Crude, Acquisitions will be for oil companies with proven reserves, Remember where you heard this first, STG £4-£6 Takeover.

EnCore revs up more Catcher wells

Shareholders in North Sea explorer EnCore Oil have been warned to expect more drilling on the Central North Sea Catcher discovery which is already estimated to contain 300 million barrels of oil on place.

At EnCore's annual meeting the company signalled plans to drill at least two more Catcher area appraisal wells and two contingent prospects– some of them with names inspired by famous motorcycles - designated Varadero in block 28/9 and another named Burgman also in block 28/9.

Varadero – named after a Honda motorcycle - is a firm well as is Catcher North, which are both slated for the fourth quarter this year, while Burgman – named after a Suzuki - and another prospect called Carnaby are both contingent wells which are to be drilled either in the fourth quarter this year or the first or second quarter next year.

In block 28/9, other prospects, similarly inspired by motorcycle names are also identified, including Rapide – after the Vincent Rapide motorcycle - to the north-west of the main Catcher field area, and Bonneville and Rocket - named after Triumph motorcycles - lying to the south-west.

Currently EnCore is waiting for a weather window for a rig to move to block 28/9 for the drilling programme.

Transocean's Galaxy II rig has been earmarked for the Varadero well but has not yet arrived at the well location due to bad weather in the area. "The rig has been able to leave its previous location, and is en-route to Dundee where it will remain, hopefully for a short period only, until a suitable weather window is available to take it to the Varadero location," EnCore stated earlier this week.

Out of 16 wells drilled since 2006, EnCore has had one dry hole, made seven gas, and seven oil discoveries, and the results of one well at the Esmond field are not available.

Also at the annual meeting, shareholders were told Paul Doble, previously project direct for the Buzzard development, has joined EnCore as development advisor for Catcher.

Doble is familiar with the EnCore team after Alan Booth, EnCore's chief executive, was previouisly chairman and managing director of EnCana UK which made the Buzzard discovery before that company was taken over by Nexen.

http://www.sharetipsgalore.co.uk/encore-oil

The story so far.

For me and most in the City of London the Encore oily rags to riches story began to coalesce in September 2009 with the announcement of the 100,000,000 million company share buy-back. This certainly raised eyebrows among small cap watchers as Encore were telling the market that ALL stock bought back would be cancelled and not held in treasury. For such a small exploration outfit to announce a potential buy back of up to one-third of stock for cancellation over a 12 month period was with hindsight a major pointer. After reducing the stock in circulation by approximately 25,000,000 the company’s total share capital now rests at approx’ 292,000,000; with Institutions holding a rather large slice of the Encore pie (129,483,105) 44.3% while Director’s holdings currently stand at a respectable 9.39% or 27,461,544 million shares. Throw in a further 1.51% holding believed to be held by other Encore staff and a total of 11% is held by the company of one sort or another. I contacted Capita Registrars and Encore last week seeking clarification on any further buy backs, needless to say I was given no meaningfull information however I did manage to glean a concession on the current buy back scheme from one of the directors at the AGM. I asked if Encore were still continuing with the buy back to wit came the reply with a shake of the head “They’re a bit pricey”.

Further research leads me on to the Breagh asset sale. RWE Dea paid a total cash consideration to EnCore of US$44.7million plus £14.7m (in repayment of inter-company debt). While 20 per cent. of the consideration for the sale of EnCore (SNS) Ltd (US$12.8million) being held in an interest bearing escrow account for 12 months as security against any potential warranty or indemnity claims by the purchaser. This equates to approximately $75,000,000 going in to the Encore war-chest! A nifty piece of business indeed! In fact if you go through all of the company news it is literally a litany of success yet there are still investors out there that shy away from Encore? The mind of each investor is a strange concoction of disbelief,belief,emotion and thick handedness the ego really needs to be put away here and good old common sense should reign. Emotion should play NO part. It’s at times like these that the most determined will profit, take for instance last weeks price drop. Panic set in on rumours that there were problems with the Catcher rig/drill so up popped the shouters and the doom and gloom merchants hammering away over the internet consequently stop losses began to kick in and before some knew it they were out. Very quickly the company released an rns and the price rose locking out quite a few. Now I’m a great believer in the stop-loss but Encore oil are not a stop-loss trade. They are a cash rich,debt free,asset rich,oil rich company with a proven quality management to boot. Further rises are certain.

The whole story of Encore is akin to reading the form of a race horse if it runs like a nag don’t back it, if it has a proven track record then place your bets here! Because as Alan Booth and company keep saying the raison d etre of Encore is “A return of value to share-holders”. This is a thoroughbred investment.

Moving on to the catcher cladhan cabal of wintershall,encore,nautical,premier, sterling etc has any investor ever wondered how closely intertwined these oilers are? Their names keep cropping up with good news stories. For the life of me I can’t recall such a group of company’s that have had so much success in the UKCS over the last few years. Just how big is Cladhan? How big is Catcher? And what in the name of jumping Jupiter will Tudor Rose bring to the table? All no doubt will be revealed in the coming months but as I type away at the lap-top I can’t help thinking of Ian Dury and the Blockheads; (200(p) Reasons to be cheerful part 1!

http://brokermandaniel.com/

| ||||

|

|

18th OCTOBER 2010

RUMOURS GATHERING PACE AT ENCORE OIL

HOLD ONTO YOUR SHARES IN ENCORE, AS WE HAVE BEEN STATING ALL ALONG, THE CITY AWAITS NEWS OF A TAKEOVER APPROACH.

ENCORE ON TRACK FOR STANDING OVATION

Is EnCore Oil in the sights of one of the crude industry's big players?

The energy explorer — one of a gaggle proving that reports of the demise of North Sea oil have been greatly exaggerated — is being tipped as a prime candidate for a takeover by some of the smart cookies watching the sector.

Shares in AIM-listed EnCore are a favourite with retail punters and are worth more than eight times what they were at the start of the year, changing hands for 119.7p this morning, off 2.3p. But the chatter is that a bid price would be more than twice their value at present.

Last Thursday, EnCore's shares were sold off after the arrival of a rig was delayed by bad weather. The Transocean Galaxy II rig was stalled as it was en route to Dundee, where it will remain until suitable weather allows it to carry on to the Varadero location on block 28/9.

But traders said that they believed investors had overreacted and reckoned that the shares could fly from present levels — even without a takeover.

www.sharetipsgalore.co.uk/encore-oil

19th OCTOBER 2010

THE CITY WILL NOW REALISE THAT ENCORE AND IT'S PARTNERS ARE SITTING ON A WORLD CLASS OIL FIND

This find has whispers of up to 1 Billion barrels for Cladhan and higher numbers being branded about for Catcher

EnCore welcomes Cladhan resource estimateEnCore Oil has welcomed the latest resource estimate for the Cladhan discovery in the UK North Sea by operator Sterling Resources.

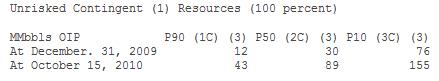

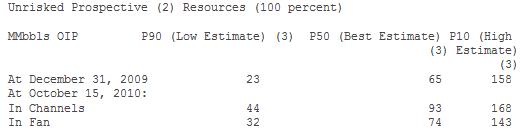

* Contingent resources: 43m barrels; 89m; 155m. * Prospective resources: 76m; 167m; 311m.

EnCore CEO Alan Booth said: "This is an excellent outcome from the recent drilling campaign.

"Even though we have yet to establish an oil water contact, these figures suggest a P50 STOIIP potentially in excess of 250mm bbls.

"Significant upside still remains on the block as can be seen from Sterling's P10 figures.

"The site survey for the next appraisal drilling location at Cladhan is under way and, dependent upon receiving the necessary regulatory approvals from the UK government and sourcing a suitable rig, we hope to return to further appraisal drilling at Cladhan in Q1 next year."

Related Quotes

| Symbol | Price | Change |

|---|---|---|

| SLG.V | 3.2800 | 0.0000 |

www.sharetipsgalore.co.uk/encore-oil

UK: Sterling Resources announces updated Contingent and Prospective Resources for Cladhan discovery

19 Oct 2010

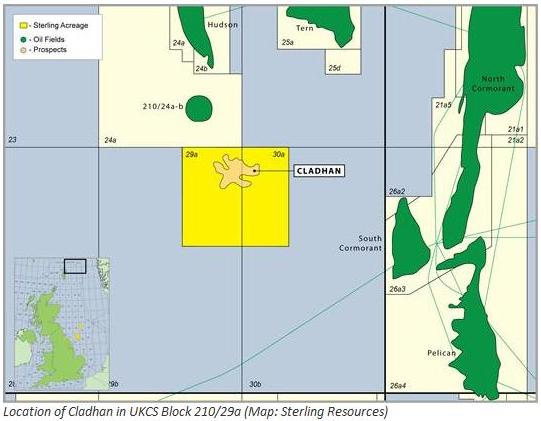

Sterling Resources has announced updated Contingent and Prospective Resource numbers (100 percent) for the Cladhan discovery (UKCS Blocks 210/29a and 210/30a) as a result of recently announced drilling success of two sidetracks from the original discovery well 210/29a-4. These Contingent and Prospective Resource figures (100 percent) have been evaluated by RPS Energy as at October 15, 2010.

P50 Contingent Resources have increased from 30 million barrels Oil in Place (OIP) to 89 million barrels OIP.

P50 Prospective Resources have increased from 65 million barrels OIP to 93 million barrels OIP in the previously assessed terrace area. An additional 74 million barrels OIP of P50 Prospective Resources is attributable to an area off the terrace and in a fan system to the east previously not assessed by RPS Energy.

'These revised Contingent and Prospective Resources numbers independently confirm the magnitude of our recent drilling successes at Cladhan,' stated Mike Azancot, Sterling's President and CEO. 'The significant upward revisions from just two new data points in high quality sands in which we have yet to find an oil water contact indicate the large potential for Cladhan. Additional drilling will be required to further delineate the size of this discovery,' added Mr. Azancot.

Subject to the completion of site survey work already in progress, conclusion of the rig selection process and regulatory approval from the UK Department of Energy and Climate Change (DECC), the Company anticipates performing another drilling campaign at Cladhan during the first quarter of 2011. The Company is also initiating evaluation work for potential development scenarios.

Sterling is the operator of Cladhan (Licence P1064) and holds a 39.9 percent working interest through wholly-owned Sterling Resources (UK) Ltd. The other partners are Wintershall (UK North Sea) with a 33.5 percent working interest, Encore Petroleum with a 16.6 percent working interest and Dyas UK with a 10 percent working interest.

Source: Sterling Resources

“This is an excellent outcome from the recent drilling campaign. Even though we have yet to establish an oil water contact, these figures suggest a P50 STOIIP potentially in excess of 250mm bbls. Significant upside still remains on the block as can be seen from Sterling’s P10 figures.

“The site survey for the next appraisal drilling location at Cladhan is underway and, dependent upon receiving the necessary regulatory approvals from the UK government and sourcing a suitable rig, we hope to return to further appraisal drilling at Cladhan in Q1 next year.”

Peter Williams B.Sc. (Hons.) in Physics and EnCore’s Group Technical Manager, who has over 35 years' engineering experience in the oil exploration and production industry, has reviewed and approved the technical information contained in this announcement.

http://www.encoreoil.co.uk/assets_cm/files/PDF/...19_october_2010.pdf

vielen Dank fuer die super Versorgung mit Nachrichten.

Ich bin noch am Ueberlegen, ob ich mit dem Rest meines Cashbestandes in Encore rein soll oder noch auf einen Ruecksetzer warten soll. Naja mal sehen.

Weiterhin gute Geschaefte.

19.10.10 09:51

Shares in EnCore Oil (EO-) slipped on Tuesday, despite the release of a resource evaluation on the Cladhan discovery in the North Sea.

EnCore - which owns a 16.6% stake in the joint venture - said operator Sterling Resources' independent resource evaluation revealed P90 contingent resource estimates of up to 43 million barrels of oil.

Its prospective resource P90 estimate ran to 76 million barrels, it added.

However, after a brief climb, its shares were over 4% down at 119.62p in morning trading.

The evaluation also showed that the discovery, located on block 210/29a, houses up to 89 million barrels of P50 contingent resources and 167 million barrels of prospective resources.

Meanwhile, its P10 estimates came in at 155 million barrels contingent resources and 311 million barrels prospective resources.

The results come less than a week after shareholders unsuccessfully pressured management for numbers at the company's annual general meeting and prompted chief executive Alan Booth to hail it an "excellent outcome" from the group's recent drilling campaign.

"Even though we have yet to establish an oil water contact, these figures suggest a P50 potentially in excess of 250 million barrels of oil.

"Significant upside still remains on the block as can be seen from Sterling's P10 figures," he added.

The site survey for the next appraisal drilling location at Cladhan is underway and, dependent upon the necessary regulatory approvals, EnCore hopes to return for further appraisal drilling at Cladhan in the first quarter of 2011.

David Hart, analyst at Westhouse Securities, commented: "We believe today's announcement represents further positive news regarding the potential at Cladhan. We are particularly encouraged to see that, subject to conditions, appraisal drilling may start again as soon as the first quarter 2011. We maintain our 'buy' recommendation."

Investors were extremely vocal in their views on the Interactive Investor EnCore discussion board following the announcement.

Jove1776 said: "Well done EnCore - have a feeling it will be a great week."

The Merlion added: "We know what we have here is massive and there is no faster way of obtaining a more accurate estimate until they have completed what they have to do. If you can afford to wait until early 2011, I would advise investors to do exactly that."

Investingisatrickygame added: "I think there will be several companies that will now want to talk with EnCore as a result of this RNS and has cemented EnCore as a takeover target."

http://www.iii.co.uk/articles/...tion=Markets&article_id=10120554

Wohl doch zu frueh, aber man weiss ja nie, wann das Angebot zur Uebernahme kommt, die Fuehler sind bereits ausgestreckt ;-)

mal sehen, wer den Zuschlag bekommt. VG

The Press and Journal Seite 20

Erscheinungsdatum 10/20/2010

CANADIAN OPERATOR SAYS FURTHER DRILLING NEEDED TO CONFIRM MAGNITUDE OF FIND

BY DAVID TELFER

A Canadian oil and gas company announced "significant upward revisions" yesterday of estimated resources in its operated Cladhan oil field north-east of Shetland.

Sterling Resources, which has an operational HQ at Banchory, saidtherevisedfigures for oil in place followed success in drilling two sidetracks from the original discovery well.

Sterling said an independent assessment by RPS Energy of oil in place had led to an increase in prospective resources from 65million to 93million barrels, with a further 74million of prospective resources in an area not previously assessed by RPS.

Including "possible resources", the discovery could contain asmany as 311million barrels.

Sterling chief executive Mike Azancot: "These revised numbers independently confirm the magnitude of our recent drilling successes at Cladhan. The significant upward revisions from just two newdata points in high-quality sands inwhichwehave yet to find an oil-water contact indicate the large potential for Cladhan.

"Additional drilling will be required to further delineate the size of this discovery."

EVALUATION The company anticipates another drilling campaign at Cladhanin the first quarter of 2011.

It is also initiating evaluation work for potential development scenarios. Partners in the licence are Sterling (39.9% and operator), Wintershall (33.5%), EnCore Oil (16.6%) and Dyas UK (10%).

Alan Booth, chief executive of UK-based EnCore, said: "This is an excellent outcome from the recent drilling campaign.

Even though we have yet to establish an oil-water contact, these figures suggest oil in place potentially in excess of 250million barrels. Significant upside still remains on the block as can be seen from Sterling's possible oil in place figures."

Mark McCue, a divisional director at investment manager and financial-planning specialist Brewin Dolphin in Aberdeen, said: "After En-Core acknowledged Sterling Resources' announcement of the find estimation at Cladhan, EnCore's shares fell by around 10%, but closed off 4.2% at 119.75p.

"It would appear that the drop in the share price was a combination of the market having already factoredin the find and investors still showing nervousness over the delay to the Galaxy II rig for EnCore's Varadero prospect in the UK central North Sea."

Bei den Umsaetzen in D wundert mich gar nichts, die sind ja wirklich nicht repraesentativ, aber 114p an AIM.

Weisst Du wie das Wetter dort oben ist bzw. ob das Rig mittlerweile auf dem Weg ist? Wo bekommt man solche updates? Vielleicht schreibe ich mal wieder an die Inv.rel. von Encore....VG

Shipping forecast and gale warnings

GALE WARNINGS

Gale warnings have been issued for the sea areas coloured in red on the map below.

Gale warnings - Issued: 1539 UTC Wed 20 Oct Northwesterly gale force 8 expected later Shipping Forecast - Issued: 1725 UTC Wed 20 Oct WindWesterly or northwesterly, backing southwesterly for a time, 4 or 5 increasing 6 to gale 8.Sea StateRough or very rough.WeatherSqually showers.VisibilityGood, occasionally poor.

www.metoffice.gov.uk/weather/marine/shipping_forecast.html#All~Forties

Na dann hoffen wir mal, dass endlich bald mal das Geheimnis gelueftet wird, wer das Unternehmen uebernimmt.

Das Rig soll morgen früh 8 Uhr Dundee verlassen, weather permitting.

Wurde bei mir geblockt, aber vielleicht kannst Du ihn öffnen.

Wenn das Rig Dundee verläßt, soll es einen Tag brauchen, um in Varadero anzukommen. Montag wissen wir wohl mehr, wir werden's am Kurs sehen.

Naja, mal sehen, wie sich das ganze weiter entwickelt. Ich denke mal, das Wetter wird im Winter nicht deutlich besser, als jetzt im Herbst. Und wenn der Kurs davon so abhaengig ist, sehe ich fuer die kommenden Wochen eher schwarz. Es sei denn die Uebernahme wird bekannt gegeben...

Small-cap of the Year

Explorer of the Year

Executive of the Year (Alan Booth)

http://www.oilvoice.com/m/n/...of_Excellence_Announced/e062ab222.aspx

Die Gewinner werden am 25. November bekanntgegeben.

26/10 - 08.00am - Galaxy II leaves Dundee

27/10 - 13.00pm - Arrives at Varadero Location

27/10 - 17.00pm - Position Rig and Jack to pre-load airgap

28/10 - 11.00am - Jack to operational airgap

30/10 - 18.00am - Spud well, drill 36"

http://www.lse.co.uk/ShareChat.asp?page=3&ShareTicker=EO.